Business Insurance in and around Burlington

One of Burlington’s top choices for small business insurance.

Cover all the bases for your small business

Coverage With State Farm Can Help Your Small Business.

Sometimes the unpredictable is unavoidable. It's always better to be prepared for the unfortunate mishap, like an employee getting hurt on your business's property.

One of Burlington’s top choices for small business insurance.

Cover all the bases for your small business

Protect Your Future With State Farm

With options like a surety or fidelity bond, extra liability, business continuity plans, and more, having quality insurance can help you and your small business be prepared. State Farm agent Adam Parker is here to help you customize your policy and can assist you in submitting a claim when the unexpected does occur.

Do what's right for your business, your employees, and your customers by reaching out to State Farm agent Adam Parker today to ask about your business insurance options!

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

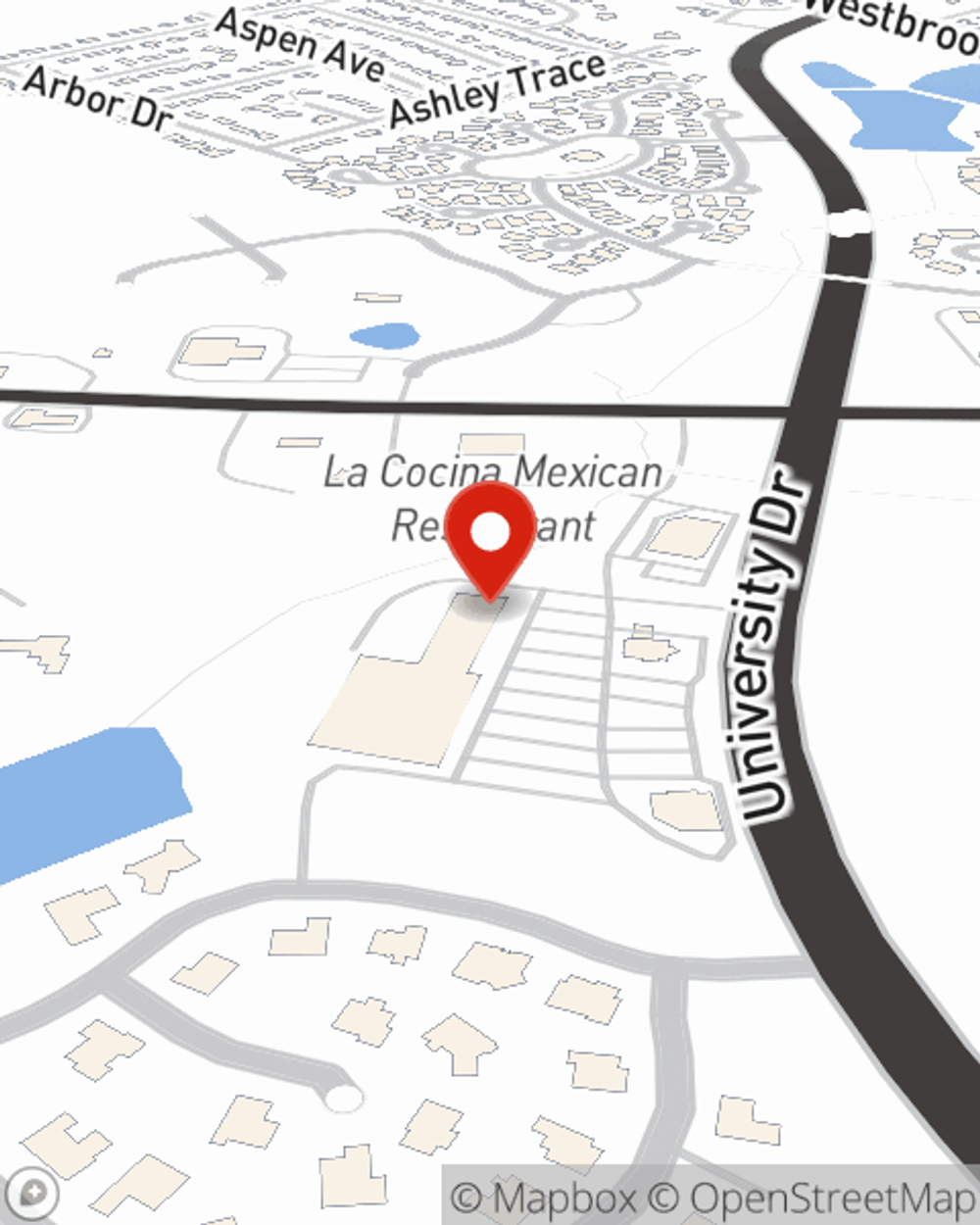

Adam Parker

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.