Renters Insurance in and around Burlington

Welcome, home & apartment renters of Burlington!

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

There's a lot to think about when it comes to renting a home - parking options, location, utilities, condo or house? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Welcome, home & apartment renters of Burlington!

Renting a home? Insure what you own.

There's No Place Like Home

The unanticipated happens. Unfortunately, the possessions in your rented space, such as a stereo, a couch and a set of golf clubs, aren't immune to theft or smoke damage. Your good neighbor, agent Adam Parker, is passionate about helping you figure out a policy that's right for you and find the right insurance options to insure your precious valuables.

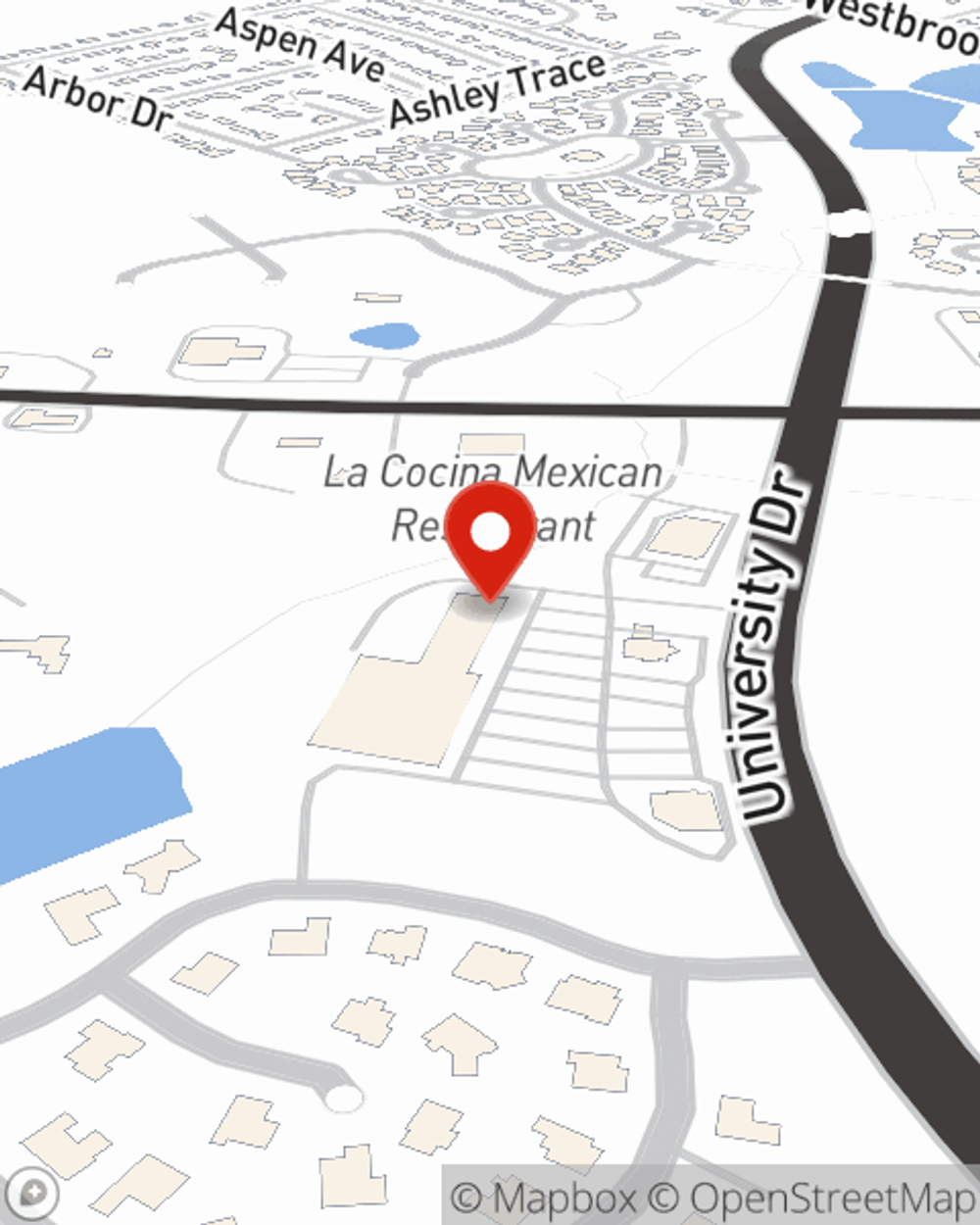

Renters of Burlington, State Farm is here for all your insurance needs. Visit agent Adam Parker's office to get started on choosing the right savings options for your rented apartment.

Have More Questions About Renters Insurance?

Call Adam at (336) 584-9231 or visit our FAQ page.

Simple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Adam Parker

State Farm® Insurance AgentSimple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.